Success stories: how the Small Business Restructure has helped Australian businesses thrive

The resilience of Australian businesses is well known, yet even the most determined enterprises can encounter financial challenges. When economic pressures mount, business owners may feel overwhelmed and uncertain about their next steps. The Small Business Restructure (SBR) can offer a strategic solution, providing a clear pathway to financial stability and long-term success. Below, we explore several illustrative examples of how the SBR has enabled Australian businesses to not only recover but also flourish.

(Please note: These scenarios are anonymised to maintain client confidentiality.)

Eligibility criteria for a Small Business Restructure in Australia

Navigating financial challenges can be daunting for small businesses, but the Small Business Restructuring (SBR) process offers a viable pathway to recovery. Introduced as part of Australia’s insolvency reforms in January 2021, the SBR process is specifically designed to help small businesses manage their debts while continuing to operate. Understanding the eligibility criteria is essential for businesses considering this option. Here, we break down the financial and operational requirements for qualifying for the SBR process.

Creating a sustainable growth plan after financial challenges

Financial challenges can be an overwhelming experience for any Australian business, but recovery offers a crucial opportunity to rethink strategies and lay the foundation for long-term success. Once you’ve stabilised your financial footing, the next step is to create a sustainable growth plan that ensures resilience while maintaining financial stability. This blog explores actionable steps to help Australian businesses navigate growth effectively after overcoming financial difficulties.

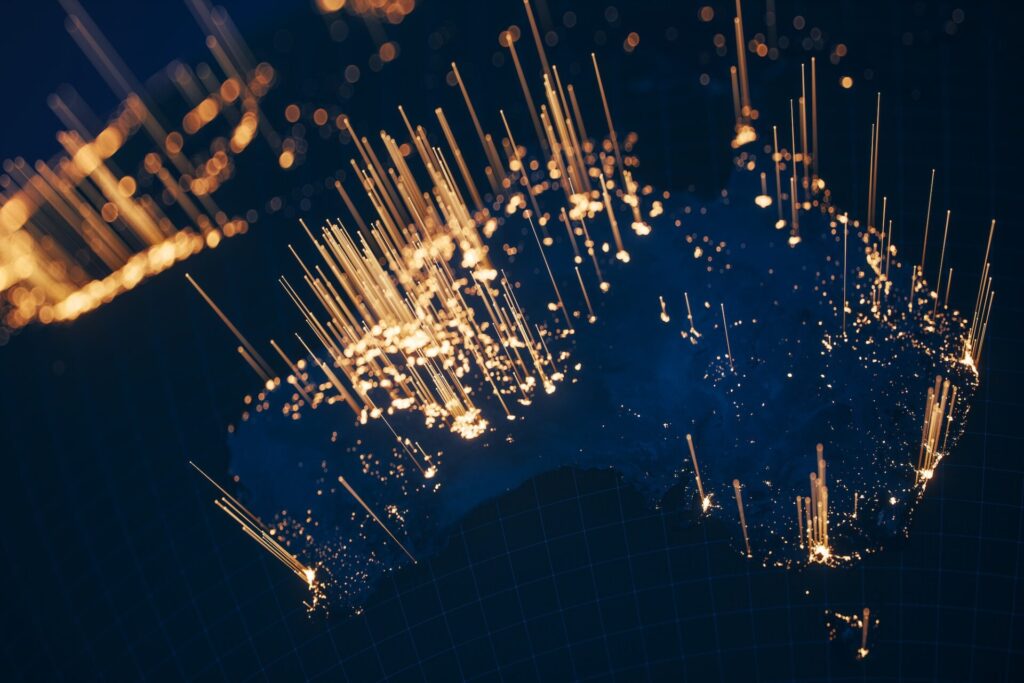

Small Business Restructure: how the Small Business Restructure supports Australian economic recovery

Australia’s small business sector has long been the backbone of the nation’s economy. With over 2.5 million small businesses in operation, these enterprises account for nearly half of all employment and over a third of the country’s GDP. However, challenges such as rising costs, changing market conditions, and unexpected global events have tested their resilience in recent years. Enter the Small Business Restructure (SBR) framework—a government-backed initiative designed to help struggling businesses regain stability while contributing to broader economic recovery.

Is the Small Business Restructure right for your business?

The Australian Small Business Restructure (SBR) process was introduced to support small businesses facing financial difficulties, offering a streamlined way to restructure debt and avoid insolvency. This initiative provides struggling businesses with a chance to get back on their feet while maintaining control of operations. But how do you know if the SBR process is the right option for your business? In this blog, we’ll explore the key considerations and signs that suggest restructuring might be the right path.